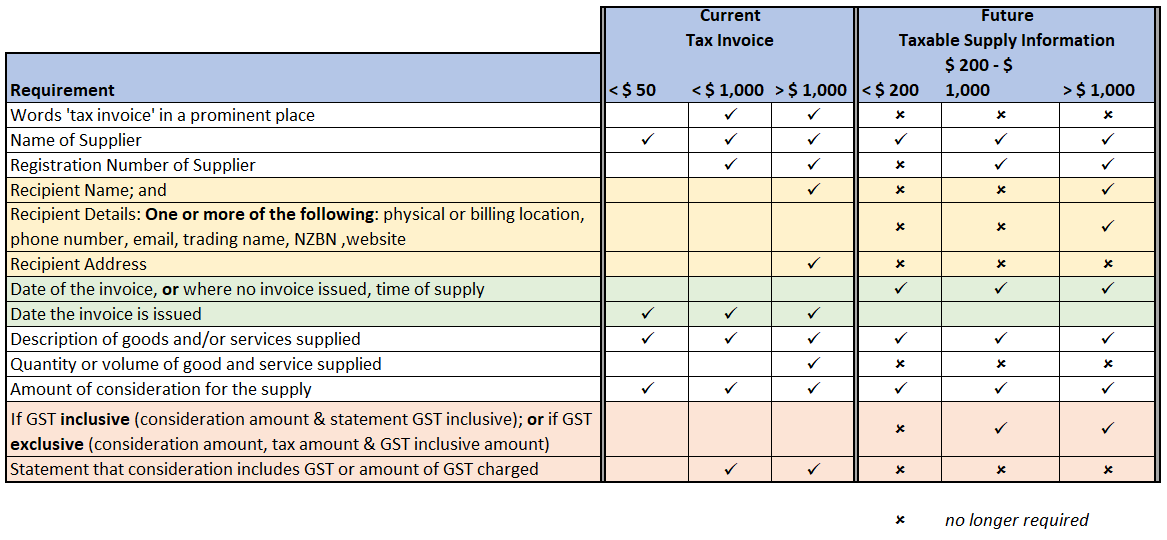

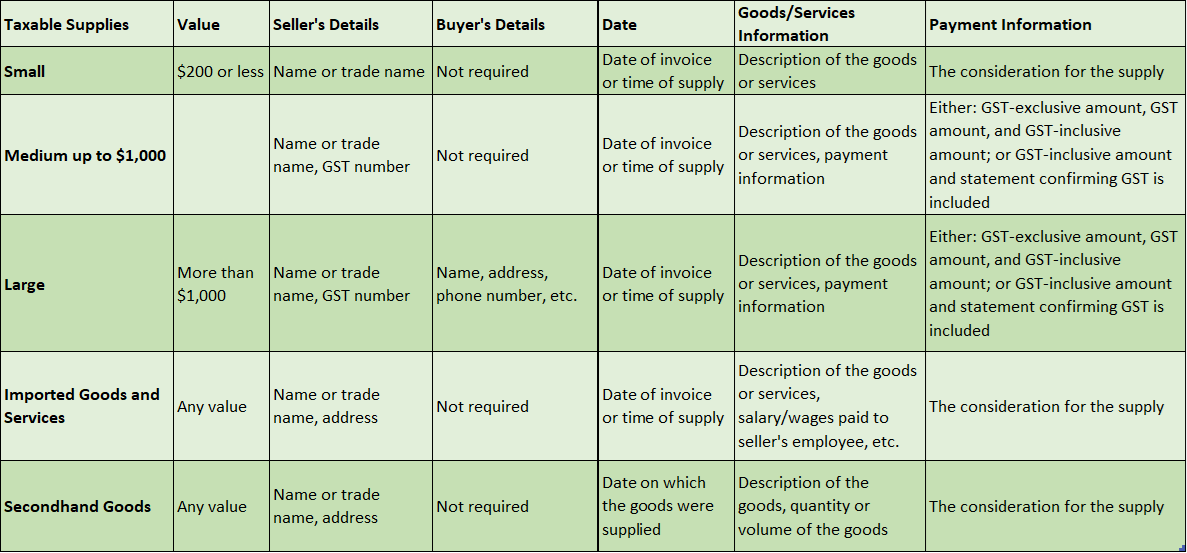

New Zealand Government Simplifies GST Record-Keeping Requirements for Small Businesses; Online Tool and Webinar Provided

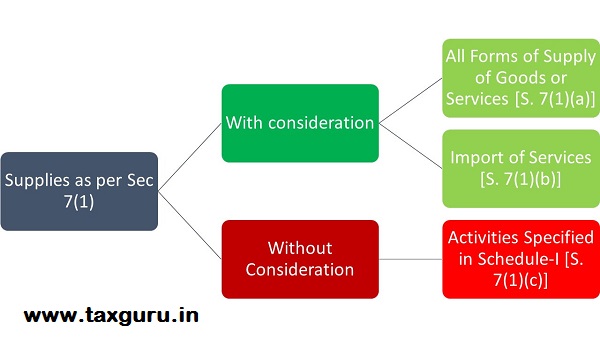

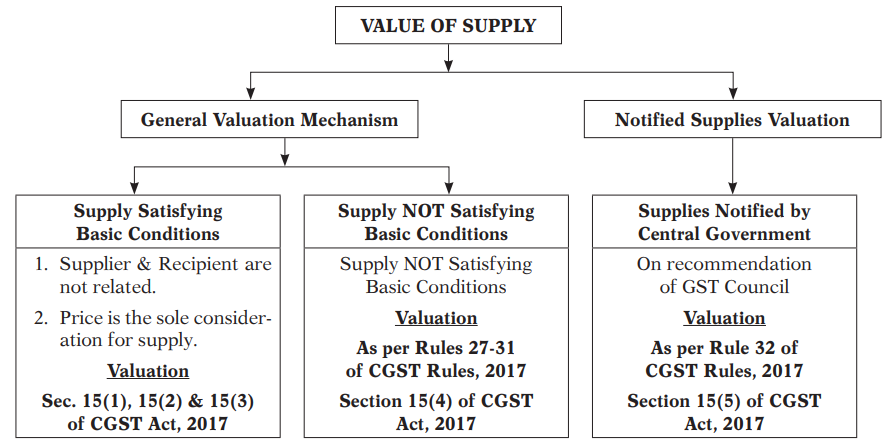

Tax Master - Have a more clear idea about GST and GST Act!😊 Know what you should & shouldn't pay under GST👍🏻 | Facebook

Amazon.com: Taxable Supplies and Their Consideration in European VAT: With Selected Examples of the Digital Economy (IBFD Doctoral Series Book 46) eBook : Kollmann, Jasmin: Kindle Store