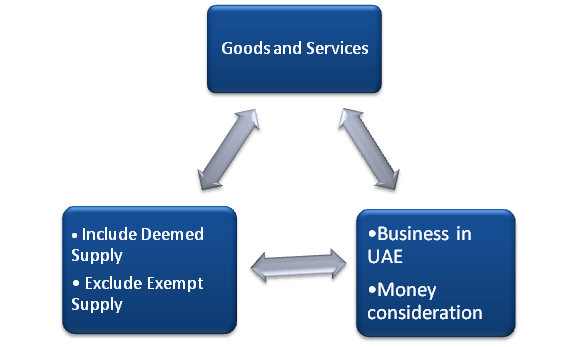

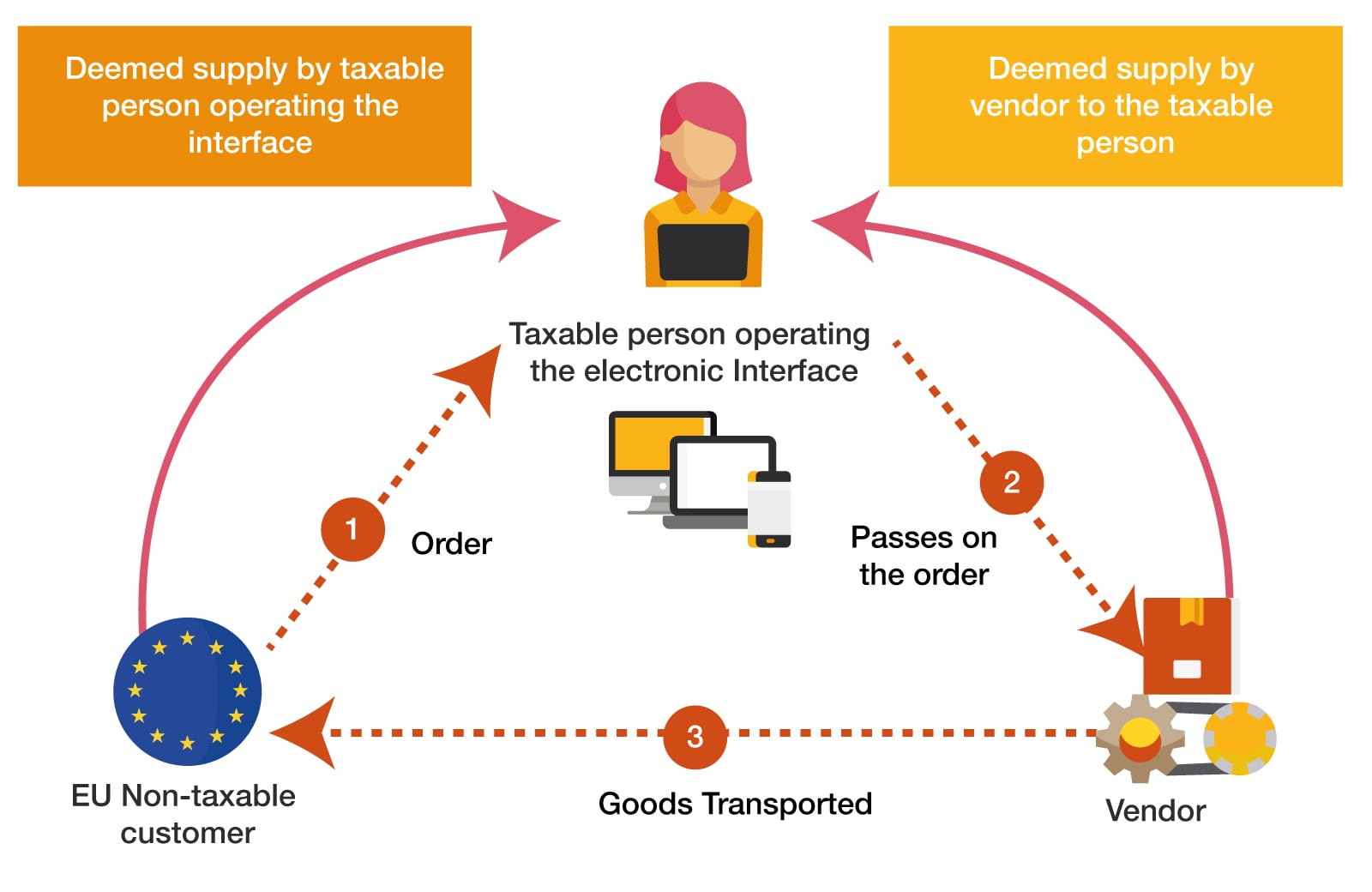

Nexdigm - With #Oman #VAT implementation on the horizon, the businesses must evaluate the compliance requirements. #DidYouKnow which supplies would be considered as deemed supply of goods under Oman VAT? Read through

We Are Open: Superior Industrial Supply is Deemed Essential Infrastructure Support - Superior Industrial Supply | Blog | Hose, Accessories, Fasteners, Industrial Supplies in St. Louis Region

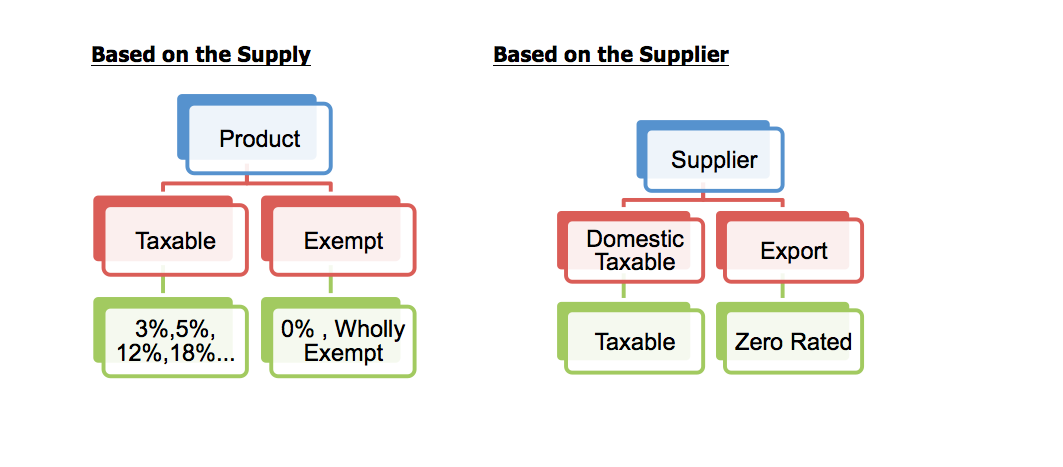

CESTAT | Services involving supply of goods/deemed supply of goods to be classified under 'works contract services' only | SCC Blog

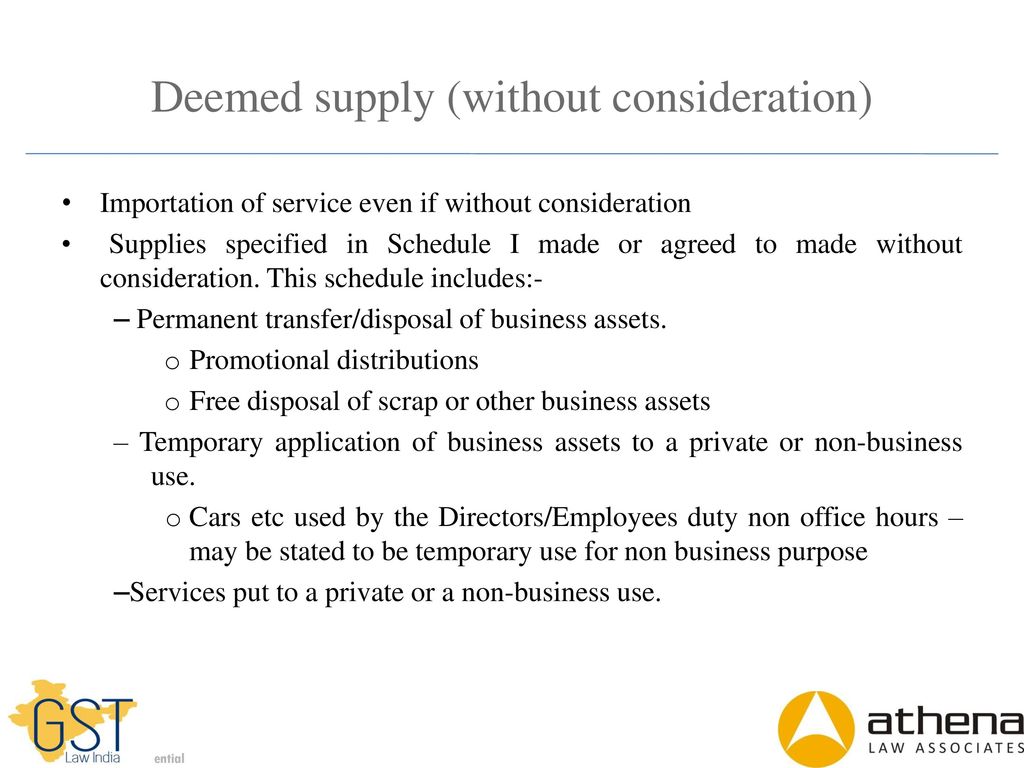

Schedule 1 - GST || Deemed Supply || Supply Under GST || CA IPCC/Inter/Final || Simple and Short - YouTube

Research Report: New Rules for Supply Chain Insights, Collaboration and Overall Resiliency | 2020-10-01 | CSCMP's Supply Chain Quarterly